Following last October's implementation of the first tranche of reforms which fixed the cost of reports in soft tissue injury claims (see attached link to DACB Insurance Adviser alert August 2014, the second tranche will maintain the focus on improving the medical reporting process, in order to achieve the Ministry of Justice's stated aim of an 'improved, robust system for medical evidence which will deter unnecessary or speculative claims.'

Tranche 2 –

- A ramdomised system of allocation of medical experts – to remove the link between the commissioning solicitor and the reporting expert, and to promote independence in medical reporting;

- A ban on solicitors from commissioning reports from Medical Reporting Organisations (MROs)or experts with whom they are linked financially – also to remove the link between the commissioning solicitor and the reporting expert, and to promote independence in medical reporting;

- A requirement that claimant solicitors run a search on their client's previous claims history via the Claims Underwriting Exchange database before submitting a claim through the portal – to satisfy themselves that their client's claim is genuine;

- A system of accreditation of medical experts who wish to provide reports in soft tissue injury claims – to ensure experts are suitably trained in the diagnosis of whiplash injury, to monitor and scrutinise their outputs, and to promote quality in medical reporting.

MedCo

To facilitate the set-up and oversee the ongoing administration of the second tranche of reforms, the MoJ has set up a not-for-profit cross-industry organisation, MedCo Registration Solutions.

Since its incorporation in January 2015, MedCo has been inviting solicitors, MROs, experts and compensators to register to use the IT hub in preparation for a system of randomised allocation (and thereafter accreditation) of medical experts.

Categorisation of MROs

Under the new MedCo regime, MROs are split into two categories:

- Larger (high volume national) organisations – those with scale and national coverage, capable of processing at least 40,000 medical reports a year, and which have contracts in place with at least 250 medical experts; and

- Smaller organisations – those with limited scale and the capability to cover s defined geographical region only.

The larger MROs will pay an annual registration fee of £75,000 to MedCo, whereas the smaller MROs will pay £15,000. The larger MROs will also be required to establish a £100,000 bond, and the smaller MROs a £20,000 bond, as security in the event they are subsequently unable to meet experts' fees. It is also possible for experts to register independently for an annual fee of £150.

DAC Beachcroft say… In view of the level of fees involved, it will be interesting to see how many experts who historically had contracts in place with MROs decide to 'go it alone'. It is likely that some will sign up with MROs and also take direct instructions.

Randomised allocation – the 'search offer'

The system of randomised allocation is due to 'go live' for all Claims Notification Forms (CNFs) submitted through the electronic portal from 6 April 2015, and will work as follows:

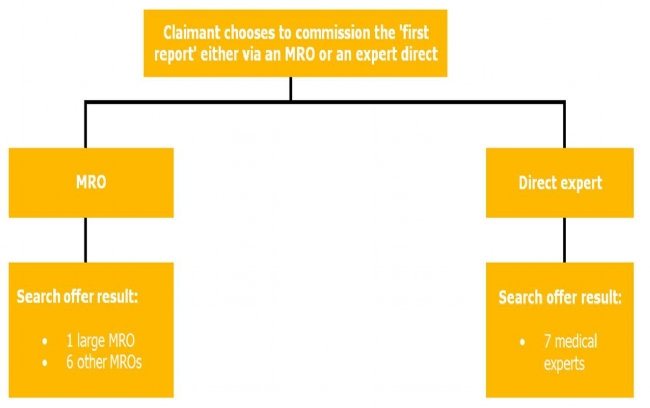

[Please refer to MROs within search offer result box below as high volume national MROs and Other MROs].

The system will return a choice of randomly generated results and the user will be able to select from those results which MRO / individual expert to instruct.

Where a solicitor chooses to instruct a direct expert, the search offer result will include a list of experts who are able to see the Claimant within a set geographical radius. Those experts will have signed up to the user agreement and will be required to meet the demands of Management Information reporting.

Ban on financial links

The registration process includes the completion of a mandatory user agreement, which includes a statement on 'direct' financial links. This will ensure that any MROs or individual experts with whom the commissioning solicitor has a 'direct' financial link are not included within the 'search offer'.

DAC Beachcroft say… It is noteworthy that the ban on financial links does not extend to husbands, wives, and other co-habiting partners of a commissioning solicitor who might own or be a director in a particular MRO.

In addition, the ban on financial links does not extend beyond the commissioning of medical reports and into the realms of rehabilitation provision. So, in theory, solicitors with their own rehabilitation arm could commission physiotherapy and/or cognitive behavioural therapy (CBT) from their own provider as soon as they are instructed, and before any medico-legal examination. We hope that newly accredited experts will be more inclined to take a robust position on the provision of rehabilitation.

JR threat

The operation of MedCo has recently been subject to application for Judicial Review, which will not be determined before 6 April and so will not affect the "go live" date.

Ask CUE PI

In keeping with the MoJ's stated intent of deterring 'unnecessary or speculative claims' , from 1 June 2015 a solicitor processing any motor claim via the electronic portal – that is to say not just a soft tissue injury claim - must first carry out a search against the Claims Underwriting Exchange (CUE) to reveal any previous claims made by the Claimant.

A new look up facility, Ask CUE PI will be set up for this purpose. The system will generate a unique reference number, which the solicitor must enter into a new, dedicated field in the CNF, as proof that the search has been completed.

There is nothing to prevent a solicitor from continuing to act if the search reveals a chequered claims history. Rather it is for the solicitor to satisfy him or herself that the claim is genuine, with the benefit of that knowledge.

In the event that the Claimant's solicitor fails to carry out the requisite search, the onus is on the Defendant's insurer or representative to raise the issue within the normal response period. If they do so, the time stops running and the Claimant must re-submit the CNF. If the Claimant's solicitor subsequently resends the CNF without first completing the search, then the Defendant's insurer / representative may drop the claim out of the portal. If the Claimant subsequently issues proceedings, the costs will be disallowed, except in 'exceptional circumstances'.

In matters where the Claimant is unrepresented, the onus falls on the Defendant's insurer / representative to carry out the CUE PI search, but there are no sanctions for failing to do so.

DAC Beachcroft say… Whilst there is nothing to prevent a solicitor from continuing to act if the search reveals a chequered claims history, the solicitor will have to satisfy him or herself that the claim is genuine, with the benefit of that knowledge. Usefully, the fact that a solicitor has conducted a search will be logged, so that if the Claimant is then turned away that will be recorded.

Regarding claims involving unrepresented Claimants, in practice these are rarely submitted via the electronic portal in any event .

Accreditation

This limb of the whiplash reform programme will see MedCo registered experts subject to a mandatory system of ongoing accreditation. A deadline of 1 January 2016 has been set for experts to achieve such accreditation, failing which they will not be able to continue to provide soft tissue injury reports from this date.

Whereas the rules on random allocation and financial links will address independence in medical reporting, so the accreditation scheme will address quality of medical reporting.

MedCo, which will ultimately be responsible for the ongoing governance of the accreditation process, have set up an Accreditation Sub-Committee to work on the rules of accreditation, but it is likely that this will involve the following component parts:

- Training – initial and ongoing training / Continuous Professional Development in the latest developments/research in whiplash; and a basic understanding of bio-mechanics.

- Audit – the periodic use of both peer review and audit to monitor performance and identify areas for development / improvement.

- Management Information (MI) – the use of MI to aggregate data, and compare outputs based on a series of pre-determined variables, such as diagnosis, prognosis, treatment, etc.

- Sanctions – the use of sanctions as an effective governance tool to ensure compliance.

DAC Beachcroft say… Absent an objective test for the diagnosis of whiplash, the importance of a bespoke, continuous training programme for experts reporting in soft tissue injury claims cannot be overstated.

Audit is a sound method of quality assurance and should not be limited to experts who are judged to be under-performing.

Management Information will be at the very heart of the accreditation process. Once a bank of cumulative data has been built up, it will be easy to identify experts whose reports are out of kilter with their peers.

In order for the accreditation system to work effectively, it must have 'teeth' – that is to say tough sanctions must be imposed on those who flout the rules or seek to undermine the process. The fact that MedCo have already set up an Audit and Sanction Sub-Committee is an encouraging sign, but it will need to weed out bad practices to avoid experts and MROs resorting to 'business as usual'.

Summary of reforms

|

CNFs submitted on / after … |

Reform |

|

1 October 2014 |

Fixed fees for medicals |

|

6 April 2015 |

Random allocation rules and ban on financial links |

|

1 June 2015 |

CUE PI changes |

|

1 January 2016 |

Accreditation |